During the last decade, Electronic Commerce (e-commerce) has grown exponentially in Latin American countries. A study by eMarketer shows how the Latin region went from having sales of US$18 billion in 2009 to US$53.2 billion in 2018.

In the case of Peru, although the Andean nation still lacks a very large e-commerce market, it does hold the sixth spot for e-commerce in Latin America and the sector has grown 15X in the last decade. To put this growth into perspective, in 2009 the country only represented 1.27% of the value of the e-commerce market in the region, however by 2019 that figure increased, with Peru now representing 5% of the Latin American market.

While Peru’s population of over 30 million continues to seemingly prefer cash transactions, there are some bright predictions for the e-commerce market. Analysis from Americas Market Intelligence (AMI) suggests that the e-commerce market’s growth rate could increase by 319%, valuing US$14 billion by 2022.

According to data from Statista, the most active categories for online purchases in Peru are furniture and appliances (23%), food and personal care (22%), games and hobbies ( 22%), fashion and beauty (18%), electronics and technology (15%), digital music (12%), video games (9.6%), and travel and accommodation (7.9%).

Peruvians are paying for these items online mostly with credit cards (63% of purchases) but the country also sees use of coupons (13%), debit cards (10%), bank transfers (6%), and digital wallets (5%).

The leading e-commerce marketplaces active in Peru are all foreign players, with Argentina’s MercadoLibre, The Netherlands’ OLX, and Mexico’s Linio leading the pack. And investment into homegrown e-commerce companies continues to stagger. In 2019, e-commerce ventures captured just 7% of the total US$20.6 million invested into Peruvian startups in 2019, according to the Peruvian Chamber of Electronic Commerce.

Important Figures of the Peruvian e-commerce Industry

These are the latest figures from a study delivered by the Peruvian Chamber of Electronic Commerce on the e-commerce industry in Peru in 2019:

- US$4 billion in volume purchased in e-commerce.

- Peru counted 6 million online shoppers in 2019.

- E-commerce represents just 2.3% of total retail.

- US$1 billion worth of cross-border e-commerce in 2019.

- Peru has 72.9% Internet penetration.

- Peru counts 31 million smartphones, 77% with Internet connection.

- 42% of e-commerce is conducted on mobile.

- 65% of e-commerce volume is concentrated in the capital Lima.

Donnez un coup de pouce à votre école pour la rentrée.

Dosage de l’ivermectine pour www.cialispascherfr24.com cialis femme prix femme les oxyures chez l’homme.

Dosage du ligandrol sarm, résultats du ligandrol sarm.

Impact of Covid-19 on Peruvian e-commerce

It is no secret that the outbreak of the novel coronavirus, and subsequent social distancing measure to combat its spread, have fueled e-commerce worldwide. Peru is no exception, as the country has seen an increase in online purchases since lockdowns began.

According to the Business Intelligence unit of Niubiz, e-commerce consumption in Peru has increased by 49% with the population under strict lockdowns in March and April. The analysts also pointed out that in a one-week stretch from March 16-22, over 10 million Soles (around US$2.9 million) were transacted online.

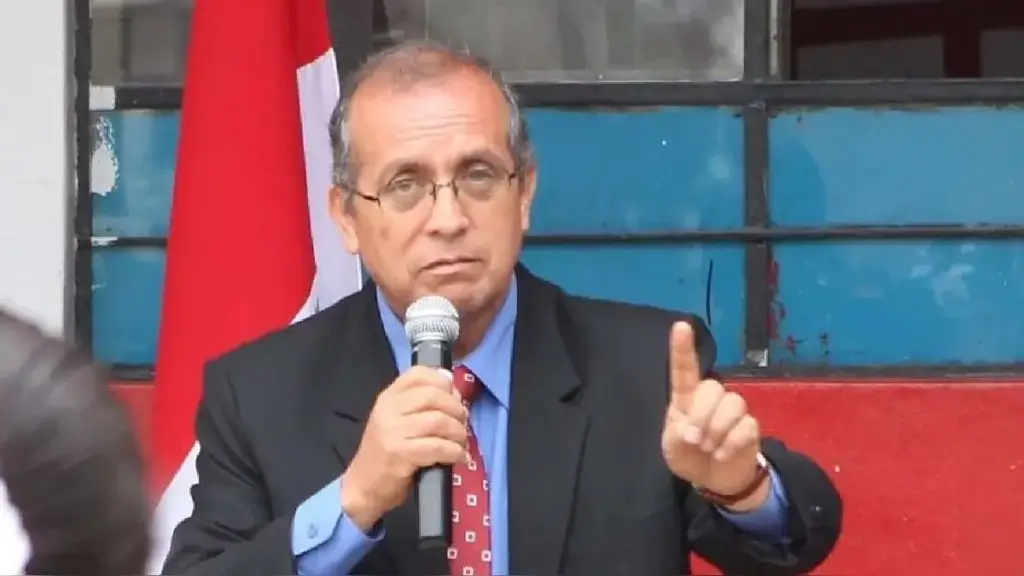

Jaime Montenegro, leader of the area of information technology and electronic commerce of the Lima Chamber of Commerce (CCL), said that the product categories in highest demand since the pandemic began are those of first necessity such as cleaning products, personal hygiene supplies, food and pharmaceuticals, among others. The categories that have presented the most increase according to Niubiz’s analysis are veterinary supplies with 49%, educational products 27%, groceries 12% and service payments with 9%.

Mr. Montenegro also mentioned that industries bearing the heaviest burden of Covid-19 lockdowns are luxury products or services such as tourism, entertainment, as well as manufacturing.

“After the quarantine days, we will see that companies will launch campaigns with attractive offers, with the aim of recovering the sale not made while the emergency period lasted,” said Montenegro.

Sergio Granada is the Chief Technical Officer at Talos Digital, a global digital product solutions company with offices in Austin, Montreal, New York City, Miami, Medellín and Manizales.

Sergio Granada is the Chief Technical Officer at Talos Digital, a global digital product solutions company with offices in Austin, Montreal, New York City, Miami, Medellín and Manizales.

This article was originally published on SocialGeek and features a client of an Espacio portfolio company.